What Forming an LLC Can Do for You as a Trader

0 Comments

/

If you’re new to being a full-time active day trader, there…

What to Know About Taxes Before Structuring Your Trading Business

So, you’ve decided to make day trading your full-time career.…

S Corporations for Traders: Why They’re a Bad Idea

When you decide to take your day trading business to the next…

The Benefits of a Partnership LLC

Owning and operating your own business can be stressful, especially…

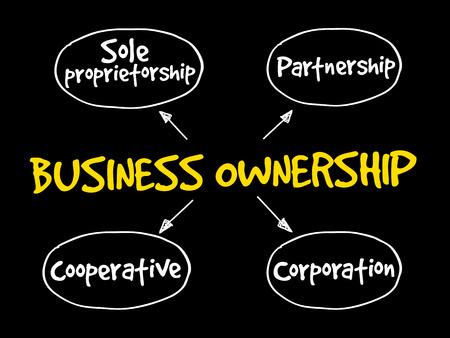

Business Entity Formation Types

All businesses are not created equal. There are differences…