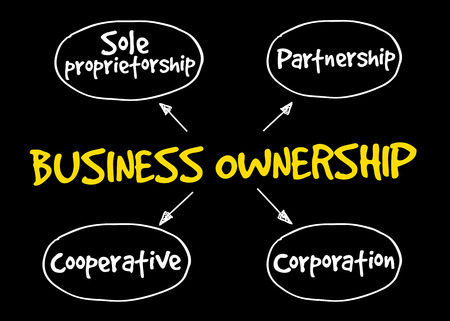

Business Entity Formation Types

All businesses are not created equal. There are differences in ownership, control, and taxation. It’s important to understand the various types of businesses before starting one.

Here is a brief overview of the different business entity formation types:

Sole Proprietorship

This is, hands down, the simplest type of business entity that you will find. A sole proprietorship is any business that has just one person who owns and operates the entire company. If you start your own business and you’re the only owner, it will be reported in your individual tax return and will be subject to regular tax and self-employment tax.

General Partnership

There are at least two partners who own the company and each partner can legally make decisions for the partnership.

Limited Partnership

Limited partnership business entities are a lot like general partnerships in that they have two or more people who technically own a company. But they have at least one partner who is a “silent partner.” They don’t make business decisions and primarily just invest in the business from a financial standpoint.

C-Corporation

Now we’re getting into the slightly more complicated types of business entities. In a C-corporation, there are shareholders (the owners of a company), officers, and a board of directors that control a company. There are numerous tax laws and regulations that C-corporations must abide by. S corporations have many similarities to a C corporation, but they are pass-through entities. And you cannot deduct everything that is available to the C corporation.

Limited Liability Company

This type of business entity offers limited liability protection to owners as far as business debts and liabilities are concerned. LLCs are generally taxed according to partnership rules. They don’t involve as many corporate formalities as you’ll find with C-corporations and S-corporations.

Could you use a hand as far as keeping up with the accounting for your business and filing your taxes? Trader’s Accounting can assist those with C-corporations, LLCs, and combination structures. Contact us today to get the assistance you need for your active trading business.

Leave a Reply

Want to join the discussion?Feel free to contribute!