Posts

Here's What You Should Know About Startup Costs if You Plan on Incorporating Your Trading Business

0 Comments

/

As an active day trader, there can be many advantages to incorporating…

Everything You Need to Know About a Registered Agent for Your Trading Business

Navigating all of the legal and logistical requirements of forming…

What Are the Advantages of Forming a Business in the State You Reside In?

If you work as a day trader, incorporating your enterprise is…

S Corporations for Traders: Why They’re a Bad Idea

When you decide to take your day trading business to the next…

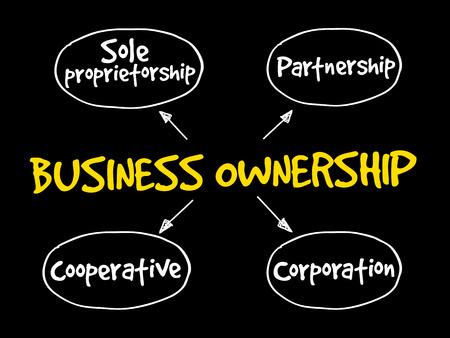

Business Entity Formation Types

All businesses are not created equal. There are differences…